About This Service

My name is kunal gupta. I am a patent professional expert having a 7+ year of experienced in patent search and analytics. I have provides patent search services such as Prior art search, Infringement search etc.

Prior art search

1-Prior art search is a key concept in patent prosecution and litigation A prior art search is undertaken to ascertain the novelty of your invention and to understand what is already known about the invention. Prior art covers all information that has been disclosed publicly, in any form and anywhere in the world, before a given date of your invention. It includes not only previously published patents, but also non-patent literature i.e. any published material, scientific papers, articles, videos etc.

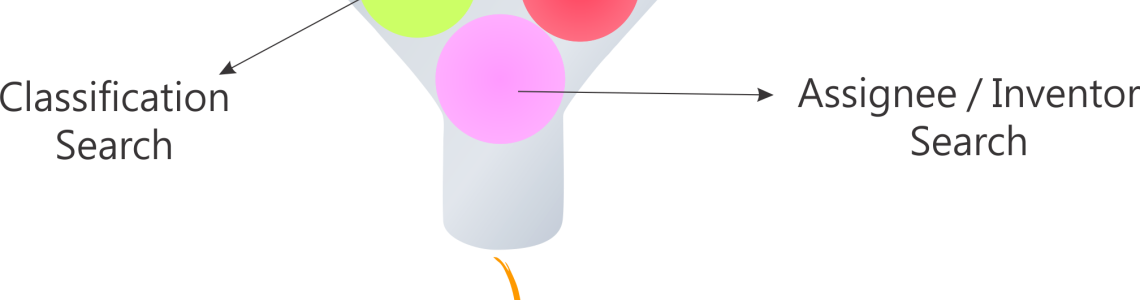

We utilize best strategies to uncover essential information that includes:

- Understanding the claims/novelty of the invention

- Keyword based search (broad and narrow technical terms) - Combine the keywords in a logical fashion to form search queries.

- Classification based search

- Assignee and Inventor based search (logically relevant keywords, inventors or classes are combined to create a complex query to approach more relevant results)

- Patent citation analysis (analysis of forward and backward patent and non-patent citations of the most relevant patents identified in the above steps)

- Non-patent literature search

Invalidity search

Patent invalidity/validity searches are conducted to either validate the claims made by a patent or to invalidate one or more claims of a competitor’s patent. It is the first step taken by a company when faced with a patent infringement lawsuit. Validity searches are also conducted to check the strength of a granted patent while exploring the available licensing options.

An Invalidity Search is a prior art search done after a patent issues. The purpose of an invalidity (or validity) search is to find prior art that the patent examiner overlooked so that a patent can be declared invalid. As a searcher, we are expected to dig deep into the domain to find critical prior art overlooked by the patent examiner, which would allow the client to challenge another’s patent (“invalidity”) or be prepared to defend a patent infringement allegation by a competitor (“validity”).

Patentability search

A Patentability search is designed to tell you the likelihood of obtaining a patent on your idea. Although the law does not require that you do a patentability search before filing a patent application, however often a search is the right first step in the patent process. Searching for the novelty of your product is a wise step before you commence its production to ensure that your idea is extremely unique and patentable.

Patentability search can be performed much earlier during the development of an invention, it is more commonly performed prior to submitting a patent application to check the feasibility of the invention.

Infringement Search

Determining and measuring the scope of infringement is essential for future litigations, royalty earning purposes and licensing opportunities. We understand the expensive attorney time and huge money involved in complex litigations and therefore offer strategic solutions for identifying technology standards or potential products that may be infringing your patent.

We mine for technical literature to identify products, systems, or services using similar invention as claimed in the subject patent. We provide EOU charts through extensive market analysis of identified products.

Freedom to operate search

Before you begin the commercialization of your product/technology, it is essential to conduct a freedom to operate (FTO) search to ensure that the desired product can be safely launched in a specific market (countries or regions) without infringing or violating third party intellectual property rights within that particular jurisdiction. It can be conducted at any stage of product life cycle to determine the direction of product/technology development.

To establish an FTO, we first conduct a Clearance Search or non-infringement Search locate any granted and alive (in-force) patents or patent applications.

What seller need from the Buyer to get started?

In case of prior art search,

Please provides the invention disclosure in case of patentability search

please provides the subject patent to invalidate in case of invalidity search

please provides your product features in case of Freedom to operate search..

The Half of the payment will be made before delivering the project...The client satisfaction is my satisfaction..